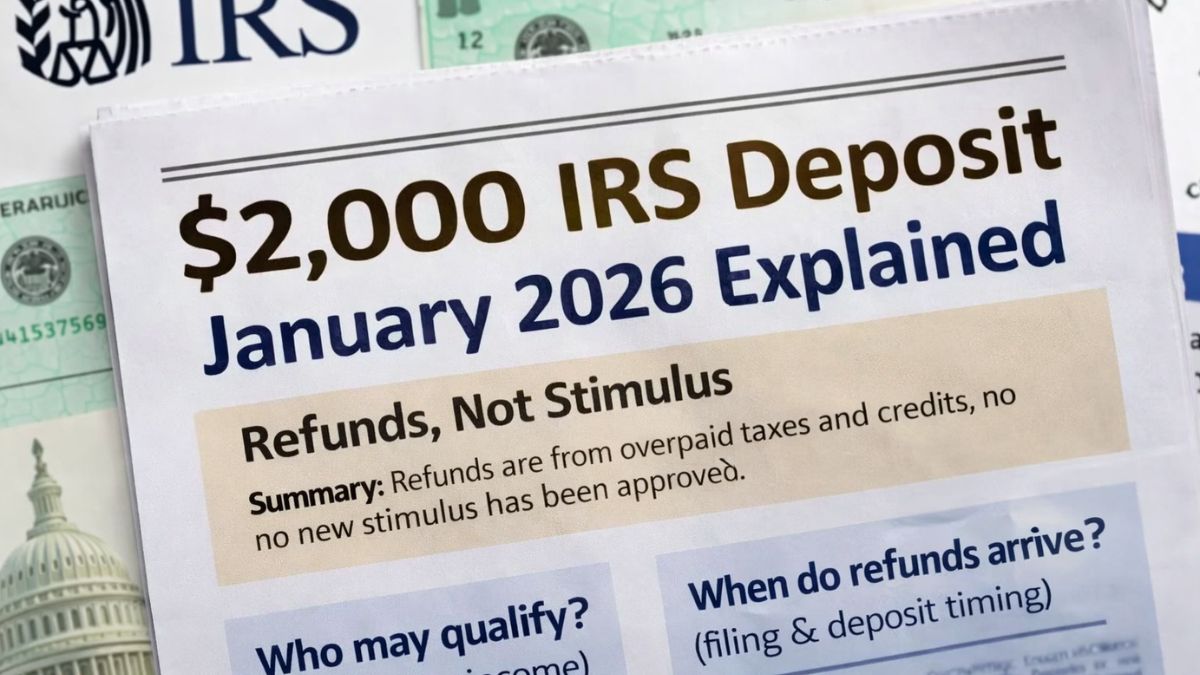

IRS $2,000 Deposit January – As January 2026 gets closer, a lot of Americans are seeing posts online claiming the IRS is about to send out a $2,000 payment. Some call it a new stimulus check, others label it emergency relief or a surprise deposit. With rent, groceries, utilities, and everyday costs still feeling high, it’s easy to understand why this idea is getting attention. But once you look past the headlines, the truth is far less dramatic.

No New $2,000 Stimulus Has Been Approved

Despite what viral posts suggest, there has been no law passed and no official announcement approving a universal $2,000 payment for January 2026. Congress has not authorized a new stimulus program, and the Internal Revenue Service has not rolled out any special relief deposit. Any money people receive in January is part of the normal tax refund process, not new government aid.

Why The $2,000 Amount Keeps Showing Up Everywhere

The $2,000 figure appears so often because many refunds naturally land around that range. When paycheck withholding is a bit higher than needed and refundable credits are added, totals often come close to $2,000. That number makes a strong headline, so screenshots spread fast. Context usually gets lost, and a regular refund starts looking like a nationwide payout when it isn’t.

Who Might Actually Get An IRS Refund In January

Not everyone will receive a refund in January. It depends on when you file, how you file, your income, and whether you qualify for credits. People who file early and choose direct deposit are more likely to see refunds sooner. Others may not receive anything until February or later. Some taxpayers won’t get a refund at all if they didn’t overpay or don’t qualify for credits.

How IRS Refund Timing Really Works

Refunds aren’t sent on one single day. They go out gradually as returns are processed and approved. Early filers often get paid first, but returns with errors or extra review needs can take longer. This is normal and part of fraud prevention. A delay doesn’t automatically mean there’s a problem with your return.

Direct Deposit Versus Paper Check Refunds

How you receive your refund matters. Direct deposit is the fastest option once a return is approved. Paper checks take longer because they depend on mail delivery, which can be slow or unreliable. That’s why direct deposit remains the recommended choice for speed and security.

Common Misunderstandings About January Refund Deposits

A big misunderstanding is thinking everyone gets exactly $2,000. Refund amounts vary widely. Another misconception is that refunds are automatic. You must file a tax return to receive one. If you don’t file, there’s no refund coming, no matter what social media claims.

Social media amplifies confusion. A few people posting refund screenshots quickly turns into rumors of a national payment. Blogs and videos repeat the claim without explanation, and soon “some people got refunds” becomes “everyone is getting $2,000.” That jump creates false expectations and unnecessary stress.

Staying Safe From Refund And Payment Scams

Refund rumors attract scammers. Fake emails, texts, and calls may claim your payment is waiting or ask for personal information. The IRS does not send surprise messages asking for banking details. Always check your refund status through official tools. If something feels urgent or guaranteed, it’s likely a scam.

Planning Smartly For The 2026 Tax Season

Knowing that January deposits are regular refunds helps with realistic planning. Focus on filing accurately and early, gathering documents ahead of time, and choosing direct deposit. These steps won’t create extra money, but they can reduce delays and make tax season smoother.

Final Thoughts

There is no new $2,000 IRS stimulus payment coming in January 2026. What people are seeing are regular refunds based on individual tax situations. Understanding this helps avoid misinformation and disappointment. Relying on official sources and realistic expectations makes approaching the 2026 tax season far less stressful.

Disclaimer

This article is for general informational purposes only and does not constitute financial, tax, or legal advice. There has been no official approval of a universal IRS $2,000 stimulus payment for January 2026. Refund amounts, eligibility, and payment timelines vary based on individual tax situations and current IRS rules, which may change. Readers should verify information through official IRS resources or consult a qualified tax professional for guidance specific to their circumstances.